How Canadian Snowbirds 65+ Can Navigate Rising Medical Insurance Costs

As Canadian snowbirds prepare for the 2025–2026 winter travel season, many are rethinking their plans. The cost of out-of-country and out-of-province medical insurance has risen sharply over the past year, prompting seniors to seek more informed and cost-effective strategies for coverage.

Medical Insurance Premiums Are Rising. What’s Driving the Increase?

Medical insurance premiums have increased across Canada, with Ontario experiencing some of the most significant hikes. This rise is driven by medical inflation, increased demand for services post-pandemic, and a greater prevalence of chronic conditions.

-

-

- Medical care prices and overall health spending typically outpace growth in the rest of the economy. Premium hikes of 15–25% have been reported, influenced by age-based pricing and dental coverage options¹.

- Canada’s medical trend rate is projected to rise to 7.4% in 2025, reflecting growing costs in hospital services and physician fees².

- Spending on specialty drugs, such as Ozempic, reached $662 million in 2023³.

- Over 37% of seniors report living with multiple chronic conditions⁴.

- Nearly 30% of Canadians postponed medical visits during the pandemic, leading to delayed diagnoses and increased demand⁵.

- Technological advancements improve care but raise premiums due to infrastructure and reimbursement costs⁶.

- Medical tourism is surging, adding complexity to insurance pricing⁷.

-

Together, these factors are reshaping claim environments. Insurers are responding with adjusted pricing, stricter eligibility rules, and more specific policy terms⁸.

Meet the Travellers

To put things in perspective, we spoke with two experienced snowbirds preparing for their next journey south.

Malcolm, 78, lives with stable cardiovascular and prostate conditions. He and his wife, Linda, 73, plan to spend four months in Arizona and Texas this winter.

Although Linda is in excellent health, she still received a wide range of premium estimates. Malcolm noted how the definition of medical stability, even with a doctor’s clearance, can complicate eligibility and affect pricing. “Different health care underwriters ask questions based on the bias of their insurance policy,” he explained.

Linda shared, “Choosing a modest deductible helped lower our costs, but it took time and attention to detail when comparing plans. I chose a deductible of $500, and Malcolm chose $5000.”

Their story reinforces the importance of asking questions and carefully reviewing each clause before committing to coverage. Malcolm added that misunderstanding a question and thereby giving the wrong answer can lead to a higher policy cost, or worse, the policy being declared invalid at the time of a claim.

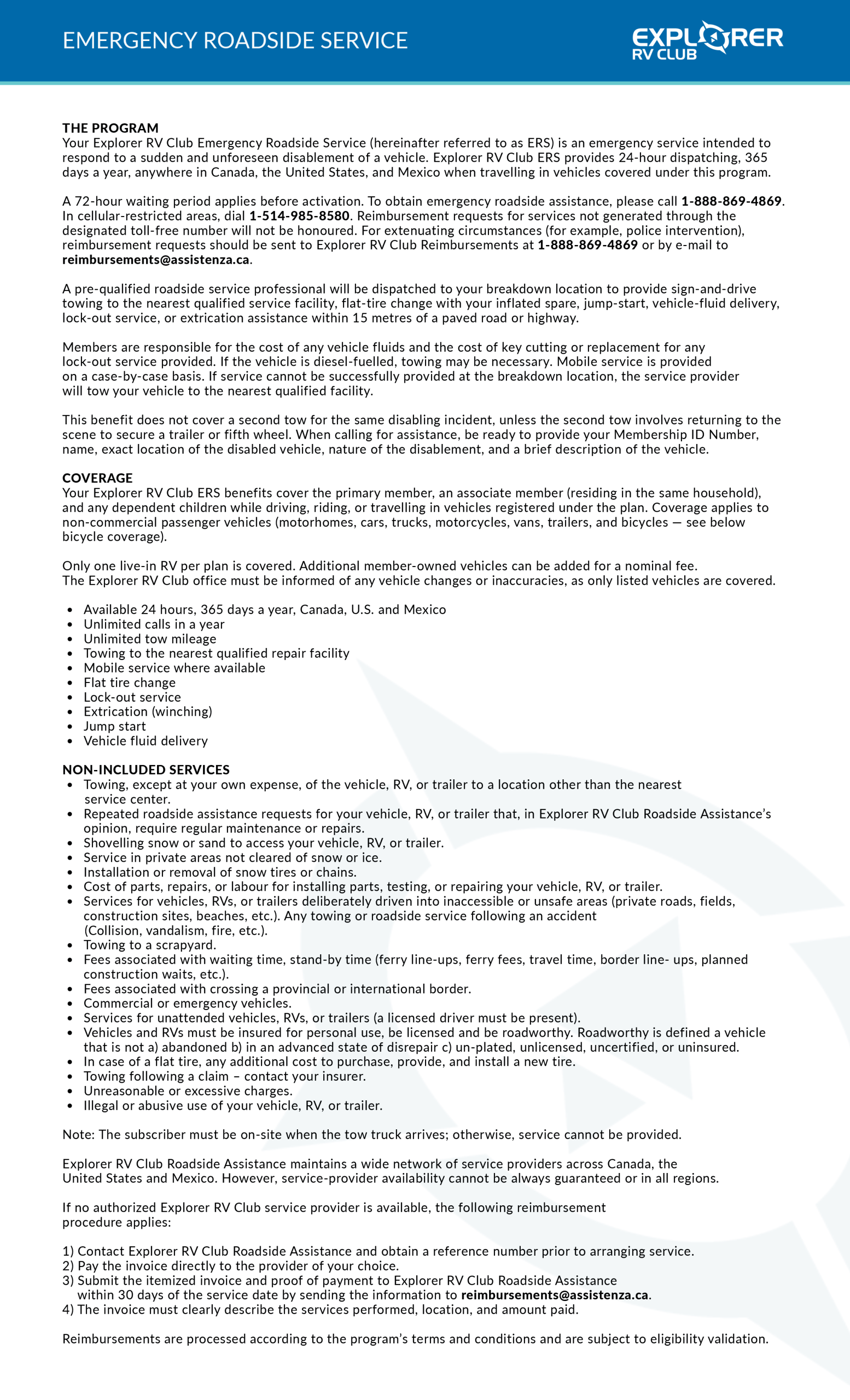

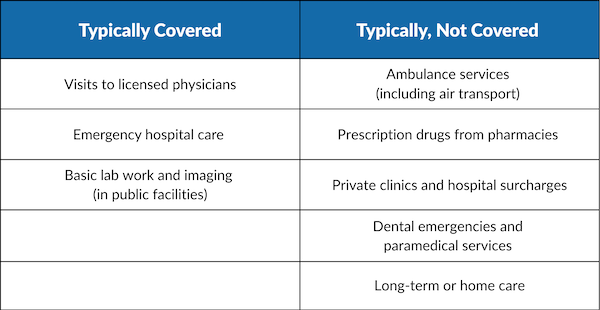

What Ontario’s OHIP Covers (and Doesn’t) When Travelling

Canadian Health Care is a provincial responsibility. Most provincial plans, including Ontario’s OHIP, are similar. They offer basic medical coverage within Canada, but benefits are often limited when travelling outside your home province. Check specific details with your home province. Most provincial plans, including Ontario’s OHIP, offer basic medical coverage within Canada; however, benefits are often limited when travelling outside one’s home province9.

A medically required air ambulance from Banff to Vancouver could cost thousands. Most provincial plans won’t cover it.

If you plan to be outside Ontario for more than seven months in any 12-month period, please notify Service Ontario to maintain your coverage. Other provinces have similar rules, with exceptions for students, seasonal workers, and mobile professionals. A change in your OHIP Medical Card can allow you to stay out of province for up to two years with no waiting period upon return. Some conditions apply¹⁰.

Note: Seniors in Ontario can apply for a six-month out-of-province supply of their regular medications before leaving. Carry all medications in their original pharmacy-supplied containers to simplify border crossing questions¹¹.

Travel Insurance Tips for Seniors

Whether heading to Florida, Vancouver Island, or the Caribbean, here are smart steps to consider:

-

-

- Start early and buy insurance soon after booking to access flexible options, such as ‘cancel for any reason’.

- Understand medical stability, as insurers typically require 90–180 days without medication or changes in treatment.

- Disclose health info accurately, as any omissions or errors can void coverage.

- Be realistic about deductibles, higher deductibles reduce premiums but increase out-of-pocket expenses.

- Check credit card limitations, some exclude travellers over 65.

- Match coverage to destination:

- U.S. travel: firm emergency medical limits.

- Mexico and the Caribbean: strong evacuation and repatriation coverage.

- Interprovincial: gap coverage to supplement provincial plans.

- Consider digital tools, look for mobile claim filing and multilingual helplines.

- Explore “Cancel for Any Reason,” available from some providers within 72 hours of booking.

- Ask your bank, many financial institutions offer medical insurance.

-

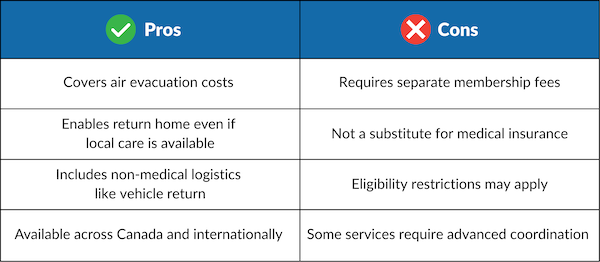

Considering Emergency Evacuation Memberships

Even with a solid insurance plan, some travellers add an extra layer of protection with medical evacuation memberships like those offered by SkyMed and similar services. These programs provide logistical support and financial coverage for emergency medical transport, especially useful when local care falls short or when snowbirds want to recover near home.

What They Offer

-

-

- Hospital-to-hospital air ambulance transport

- Ground ambulance coordination

- Return of vehicles, pets, or minor children

- Travel for companions to the bedside

- Medical escort services

- Repatriation of remains

- Freedom to choose the destination hospital

-

Evacuation memberships are especially valuable for snowbirds who spend long periods abroad or visit remote regions within Canada. Providers such as SkyMed Essentials and SkyMed International have decades of experience supporting Canadian travellers in North America, the Caribbean, and beyond.

Final Thoughts

For Canadians 65+, travel insurance has become a vital part of any journey. While rising costs can be intimidating, proper preparation can help you navigate options with confidence.

Ask questions. Compare carefully. Choose coverage that matches your health profile and travel goals. Your policy should bring clarity and calm, not confusion.

And that peace of mind? It’s the most valuable travel companion of all.

Not a member? Join the club today!

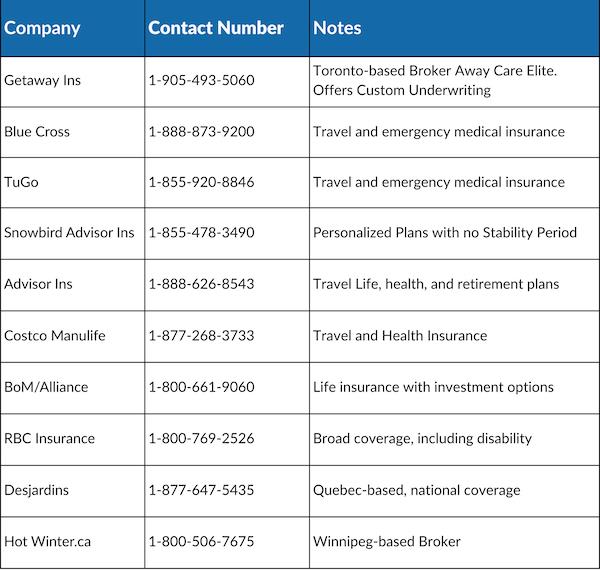

Appendix:

Insurance Providers Contacted During This Research with Contact Phone Numbers.

Footnotes

- HealthQuotes.ca – Why Your Health Insurance Premium Increased in 2024. https://www.benefitscanada.com/benefits/health-benefits/canadian-health-benefits-cost-trend-increasing-to-7-4-in-2025-report/

- Canada’s medical trend rate is projected to rise to 7.4% in 2025, reflecting growing costs in hospital services and physician fees. https://www.benefitscanada.com/benefits/health-benefits/canadian-health-benefits-cost-trend-increasing-to-7-4-in-2025-report/

- Spending on specialty drugs like Ozempic reached $662 million in 2023. https://www.cihi.ca/en/news/canadas-public-drug-program-spending-reaches-184-billion-in-2023-medications-like-ozempic-driving

- Over 37% of seniors report living with multiple chronic conditions. https://www.canada.ca/en/public-health/services/publications/diseases-conditions/aging-chronic-diseases-profile-canadian-seniors-report.html

- Nearly 30% of Canadians postponed medical visits during the pandemic, leading to delayed diagnoses and increased demand. https://www.statcan.gc.ca/o1/en/plus/735-adults-canada-delayed-seeking-health-care-during-first-year-pandemic

- Technological advancements improve care but raise premiums due to infrastructure and reimbursement costs. https://www.medicaleconomics.com/view/advanced-technology-will-help-drive-reimbursement-change

- Medical tourism is surging, adding complexity to insurance pricing. https://bestquotetravelinsurance.ca/Medical-Tourism-Insurance-Canada

- Statistics Canada – Aging and Chronic Diseases. https://openmedscience.com/medical-innovations-and-insurance-adjustments-how-advances-shape-coverage-and-policy-paradigms/

- Canadian health care is a provincial responsibility. Most provincial plans, including Ontario’s OHIP, offer basic medical coverage within Canada, but benefits are often limited when travelling outside your home province. https://caaneo.ca/magazine/protect/what-ohip-covers-outside-ontario-and-what-it-doesnt/

- A change in your OHIP Medical Card can allow you to stay out of province for up to two years with no waiting period upon return. Some conditions apply. https://www.ontario.ca/page/ohip-coverage-while-outside-canada

- Carry all medications in their original pharmacy-supplied containers to simplify border crossing questions. https://www.catsa-acsta.gc.ca/en/what-can-bring/medication-and-medical-items