Holiday spending helps you enjoy the season. Buying gifts, decorations, food, and other holiday accessories can get expensive if you’re not careful, though. Learn how to set a budget and stick to it during the holiday season and throughout the upcoming year.

Set Holiday Spending Limits

Evaluate your budget early in the season and decide how much you can spend. Your first priority is everyday bills and living expenses. Any money you have left over after you meet these expenses can fund your holiday.

To support your financial goals, resist using credit cards or loans to fund the holidays. Use cash only so that you’re not paying off holiday debt into the new year.

List Expenses

Decide exactly what you need to buy. You can always add or delete categories in a future step. For now, think big! Possible expense categories could include:

- Gifts for family, friends, stockings, social events, teachers, babysitters, etc.

- Wrapping paper and trim

- Cards, postage and shipping

- Food for parties, family meals and cookie exchanges

- Decorations

- Clothing including matching family pajama sets or ugly sweaters

- Travel costs such as fuel, plane tickets, pet sitting, and parking tolls

- Activities like sleigh rides or festival admission

- Charitable giving beyond your routine donations

- Miscellaneous expenses

Prioritize your Spending

Maybe you can afford to buy everything on your list. But if you need to cut expenses, prioritise your spending.

Start by ordering your spending categories by importance. Ask yourself which categories give you joy and increase your holiday cheer. For example, if entertaining is your favourite holiday event, place it first.

Then, review items within each category and cut whatever you can. You might decide to give gifts only to your immediate family or drive through free neighbourhood light displays instead of paid options.

Allocate Funds

Now’s the time to decide how much money you’ll spend in each category. Try to be realistic based on your actual needs and current prices. You may need to look again at your spending categories and make further cuts or add items back in as you allocate funds.

Track Your Spending

One of the most important budgeting tips you can follow is to track your spending. Start a spreadsheet or binder to list all your holiday expenses. Remember to include everything, including your holiday lattes and waitstaff tips.

Store receipts in an email or paper folder, too, so you have a more accurate look at your expenses and can easily return gifts, if necessary.

A designated account could help you track spending. Also, see your balance in real-time as you shop.

Look for Ways to Save Money

The holidays are important, but give yourself permission to be frugal and save money. Here are some ways you can save money without sacrificing the spirit of the season.

- Use coupon codes. Search online for item-specific or store-specific coupons and install browser extensions like Rakuten.

- Price match. Some retailers, including Best Buy, will match a competitor’s current price.

- Shop on Black Friday or Cyber Monday.

- Create cheaper traditions. Send email greetings instead of cards or host a potluck and game night in place of a gift exchange. You can also hand make gifts, wrapping and decorations.

- Buy secondhand. Protect the environment when you shop at thrift, consignment orc.

- Give free gifts. A home-cooked meal, night of babysitting or a book off your shelf can be as heartfelt and thoughtful as expensive items.

- Volunteer as a group. Skip the expensive office party, and volunteer for a favourite charity or community organization.

- Increase your spendable cash. Find a part-time job, sell items online or via a garage sale, and cut unnecessary household expenses.

Adapt Your Holiday Budget to the Rest of the Year

Setting a budget during the holidays can help you track your spending all year. Simply apply the principles that worked for you.

- Identify your income and expenses. Include everything you earn, including occasional babysitting or side gig funds. organize expenses into categories, such as food, clothing, etc.

- Designate a spending limit for each category. For example, decide how much you want to spend on transportation, food and all your other spending categories. Ideally, your spending should be less than your income.

- Prioritise your needs versus wants. Resolve to buy only the things you need. Also, ask yourself if a purchase will help you achieve your financial goals or put you in debt.

- Practise using your budget. Continue to track your income and expenses for a few months. Make tweaks as needed.

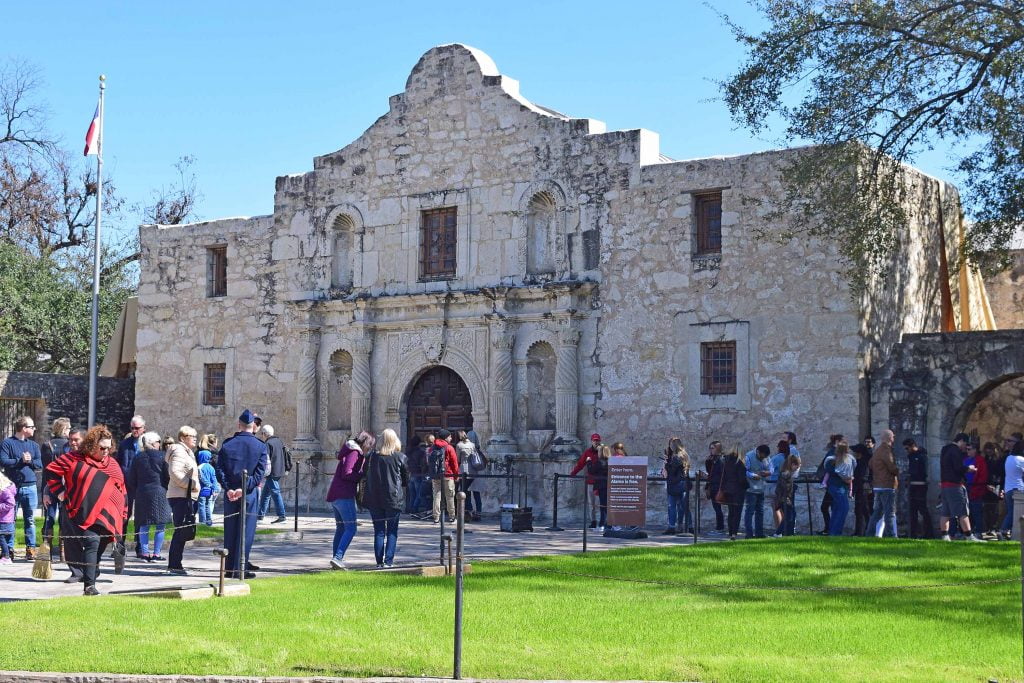

Once you set a budget, you can stick with it for the holiday and beyond. Use the money you save to fund your next RV adventure!